Wages decouple from GDP; State budgets take hit

By Gavin R. Putland

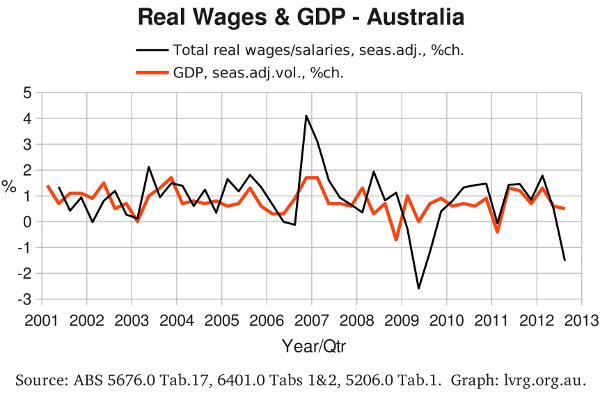

Comparing today's National Accounts (Table 1) with Monday's Business Indicators (Table 17), we see that Australia's real wage/salary bill, which bore an uncanny correlation with real GDP over the previous nine quarters, gave a pessimistic and misleading indication for the September quarter:

The nominal wage/salary bill was also pessimistic, but not to the same degree.

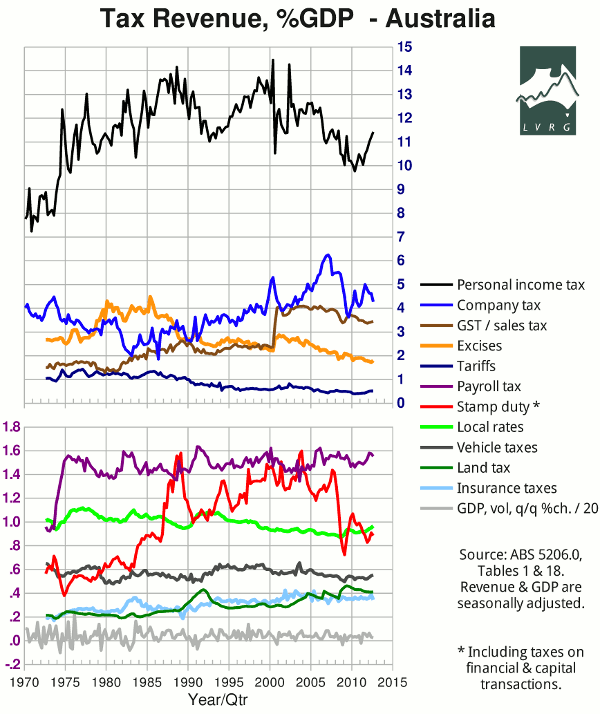

From Table 18 of the National Accounts, we can plot the revenue receipts from various taxes as percentages of GDP. In the lower panel of the graph, which shows State and local taxes, we see that receipts from payroll tax (purple), stamp duty (red) and insurance taxes (pale blue) ticked downward:

Receipts from company tax continued to fall (but figures for recent years have been revised since the last quarter). Receipts from personal income tax continued to climb, notwithstanding the fall in total wages/salaries and the lifting of thresholds; clearly the additional revenue is from non-labour income.