Stamp-duty revenue slumped again in 2011-12

By Gavin R. Putland

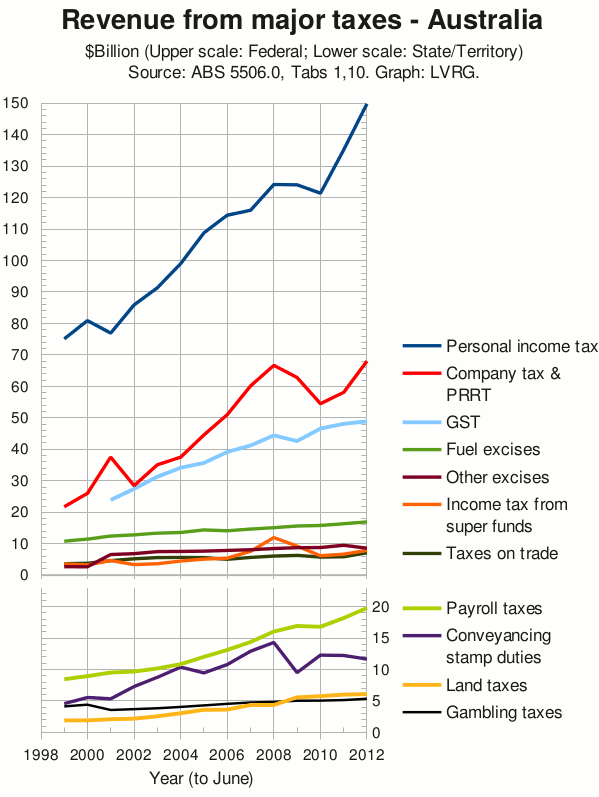

The following graphs are based on this morning's release of ABS 5506.0, “Taxation Revenue, Australia”, supplemented by earlier figures from a previous release.* We begin with the national figures, for key Federal and State taxes.

Revenue from conveyancing stamp duty is notably volatile and has slumped in the latest year shown, namely 2011-12. Company tax is also notably unreliable, but seemed to be in a recovery in 2011-12.

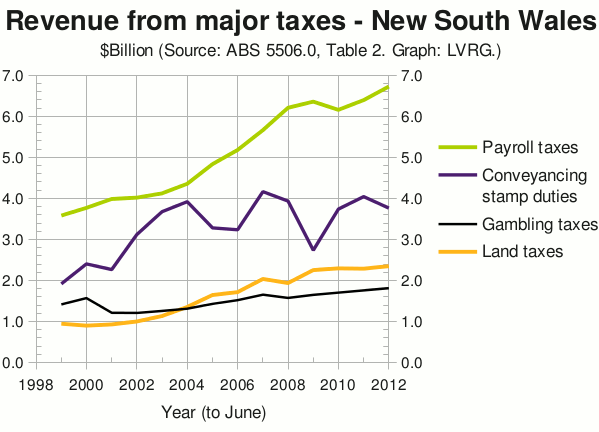

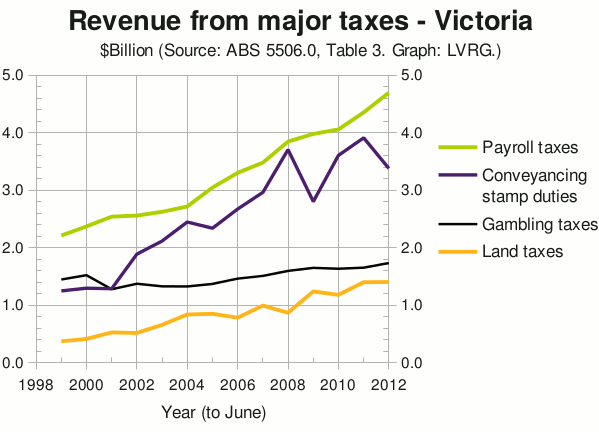

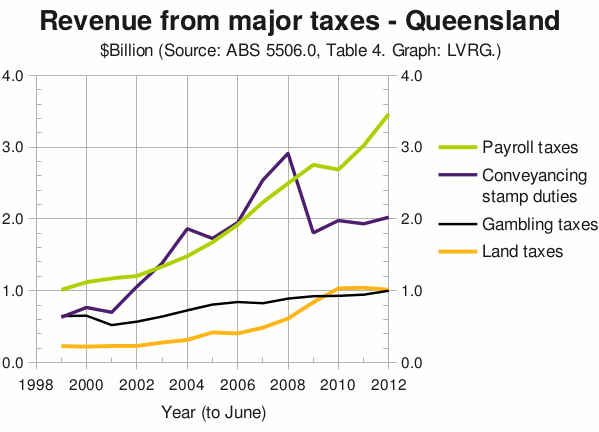

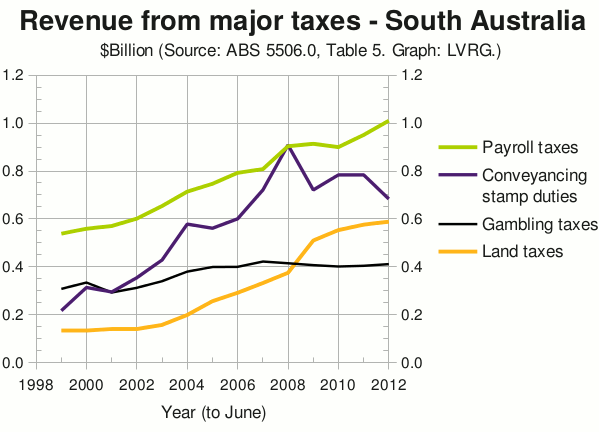

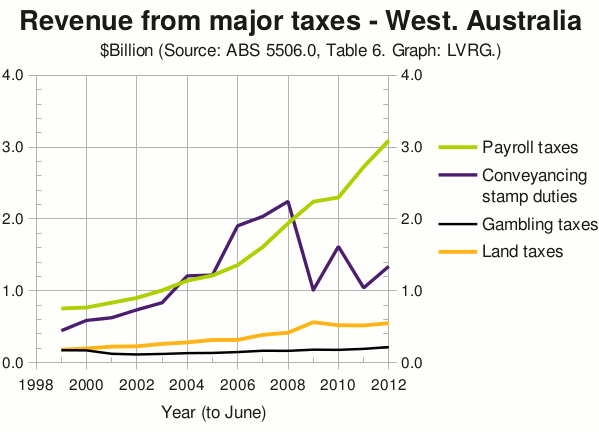

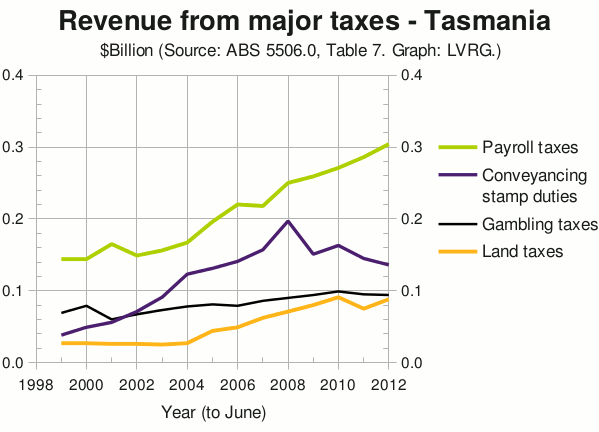

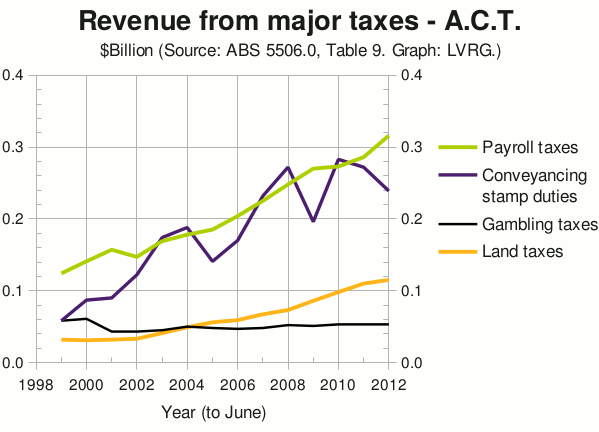

When we look at the four State taxes for each State/Territory,** the unreliability of conveyancing stamp duty is even more evident:

It can be seen that land tax is considerably more reliable than stamp duty (except in the NT, which doesn't impose land tax). Also comparatively reliable, though it pains me to say so, is the economically indefensible and constitutionally vulnerable payroll tax.

__________

* And intermediate releases in the case of the first graph.

** In the State graphs, it would have been better to rename payroll tax, conveyancing stamp duty and land tax in the singular. I don't have time to do them all again.