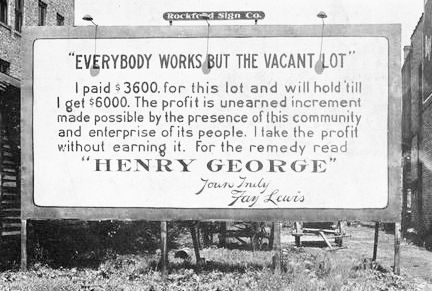

220 years later, we still avoid the issue under our feet

Use it or sell it: Rates and land tax, if sufficiently high, make it uneconomic for speculators to hold idle land. Thus land becomes more affordable for genuine users, who no longer have to compete with speculators.

Bryan Kavanagh marks the 220th anniversary of a notable letter.

Alexander Small knew that a block of land with an annual charge on it will sell more cheaply than an identical one with no such charge. He knew that taxes on productive activity add to costs and are counter-productive. So, as all taxes ultimately fall on land anyway, why not put them there in the first place? It was therefore with a sense of frustration that he had written to his friend, Benjamin Franklin, whom he knew to have an excellent understanding of the matter, on whether he still believed in the principle. Ben Franklin prevaricated; in a letter dated 28 September 1787 he replied to Small:

“... I have not lost any of the Principles of Public Œconomy you once knew me possess'd of; but to get the bad Customs of a Country chang'd, and new ones, though better, introduc'd, it is necessary first to remove the Prejudices of the People, enlighten their Ignorance, and convince them that their Interest will be promoted by the propos'd Changes; and this is not the Work of a Day. Our Legislators are all Landholders; and they are not yet persuaded that all Taxes are finally paid by the Land...”

Nothing has changed. Two hundred and twenty years later, as Australia wrestles with impossibly soaring house prices, there remains inaction on this most fundamental point.

The one thing that politicians have ruled out of the debate is the only thing that can keep the lid on escalating land values: increased levels of rates and land taxes. It is too cynical to believe that Australia's politicians themselves, being landowners, don't want rates and land taxes increased. A more reasonable explanation is that they believe supporting higher rates and land taxes won't impress their voters — particularly those with highly-valued properties not acquainted with the fact that all taxes come home to roost against land values anyway — and that opponents of the idea will resort to the politics of scare, rather than of education. However, if the increases were made revenue-neutral, and payroll taxes and stamp duties abolished, perhaps along with the GST, the case could be more easily made. All the more so if payment of rates and land taxes were allowed to be deducted in regular installments from incomes if companies or individuals chose the option.

Unfortunately, the suggestions that came out of the Labor Party's housing affordability summit in Canberra on 26 July 2007, and from Aussie Home Loans' John Symond more recently, amount to quite ineffectual palliatives which do not solve the problem of access to housing for all Australians, current and future.

[Reposted and illustrated January 30, 2009.]